If we, for just a moment, ignore everything else going on in the world and just focus solely on our own little sector, this year has been quite good. We’re coming out of three years of solid bear market, with Bitcoin going as low as sub $4000 as recently as March, this very year. A lot has happened since then, though, and we want to dive into some points that make us very hopeful for the last few months of 2020, and what the next year might bring.

Regulation

This is a big one, and there is a lot to bring up. The uncertainty of future regulatory landscapes has been a growing thorn in the industry’s side over the last few years, about and read the news of regulatory developments in countries such as the USA and here in Europe.

With examples such as New York opening up for crypto services, and Kraken gaining a Banking license, topped off with US federal banks being allowed to hold stable coin reserves, it’s hard not to be hopeful. Our outlook is that with New York(the state) leading the charge for a well-measured approach, other states are likely to follow suit. With the president-elect having a crypto-savvy financial expert by his side, we might even get to see some laws being drafted. Implementation will most likely come at a later stage, however.

While we’re sure not to take anything for granted, the future regulatory developments point in the same direction, and the same goes for our closest neighbors.

The recent draft made by the EU on the Markets in Crypto-assets Regulation(MICA), looks to bring a more comprehensive set of rules for the crypto industry, with a regulatory framework covering transparency and disclosure requirements, while at the same time establishing consumer protection rules and some financial hygiene standards, such as capital requirements and measures against market abuse. Overall, a healthy take.

With a large part (48%) of the registered and licensed cryptocurrency companies being registered in Europe, 2021 will be an important year. We’re certain that the subsequent clarity will provide a stepping stone for further growth for business, users and investors.

Another important point worth mentioning is that crypto services fall under the same AML and KYC regulations as any ordinary financial service, but that the slow and steady approach that has been implemented by the regulatory authorities for crypto specifically, since it began to attract attention back in 2011, will likely continue throughout the coming years as well.

“Regulatory support” is on a safe track to become the industry quote of 2021.

Usage

Obviously, we wouldn’t be anywhere without users who on an increasingly steady basis interact with the products and services that we produce. That’s why the development of user numbers over the last period is such a treat, with a growth in both unique wallets, transactions, and overall users.

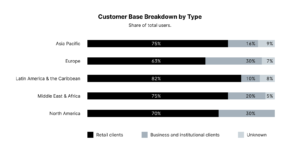

The development over the last few years has been pretty staggering, with an almost 200% growth in unique users since 2018, with over 100 million users joining just this year from across the globe. A major portion were retail customers, across all regions, though with the recent surge in interest from institutional investors, this may come to change.

If anything is indicative of healthy development, it is the growth of user base. When it’s happening on a global scale, we’re on to something.

It is no surprise that established companies have experienced a surge in users, and a good example is the popular service MetaMask reaching over 1 million active users during September constituting a 400% yearly growth.

The same pattern is repeated across the globe, with popular wallet BRD reaching new heights after a wave of new users coming from India and South America.

We might be biased, but from the looks of it, the world is coming to crypto.

Adoption

Given the amount of coverage this has received it almost feels silly to bring up, but major companies investing in Bitcoin and cryptocurrencies has been a monthly cycle, with players such as MicroStrategy, Square and PayPal pulling the cart.

While they do not account for the majority of the market by any means, major players moving into crypto is sure to yield a greater among others and cause a shift in the perception of cryptocurrencies among a growing number of interested parties. With recent statements made by personalities such as Rick Rieder, the CIO of Blackrock (the world’s largest investment firm), stating that

“Bitcoin is so much more functional than passing a bar of gold around”

and

”I think cryptocurrencies here to stay, I think it is … durable”

Mentioning in the same breath that cryptocurrencies may well take a large share of gold’s current status.

Or why not Stanley Druckenmiller, a legendary hedge fund manager.

“Frankly, if the gold bet works the bitcoin bet will probably work better because it’s thinner, more illiquid, and has a lot more beta to it.”

With EU making it’s decision on a digital euro in January of 2021, we might receive a further boost to public interest.

These kinds of events are not short on attention, and the coverage received by both public and private representatives has sure had an effect on the perception of cryptocurrencies in general, but not in the least on Bitcoin in particular. Together with the increased availability of services, we might reach post-adoption before we know it.

And we know you’re not supposed to talk about the price, but >$24 000! We had a new all-time high by market capitalization on December 19th, with Bitcoin reaching a total market cap of $423.2b.